Investigation into misleading wildfire mailers results in ban from industry

News: 2023 Press Release

LOS ANGELES — A California Department of Insurance investigation into misleading mailers on insurance claims following wildfires has resulted in the ban of public adjuster and California Recovery Group owner/director, Argen Youssefi, 32, of Glendale.

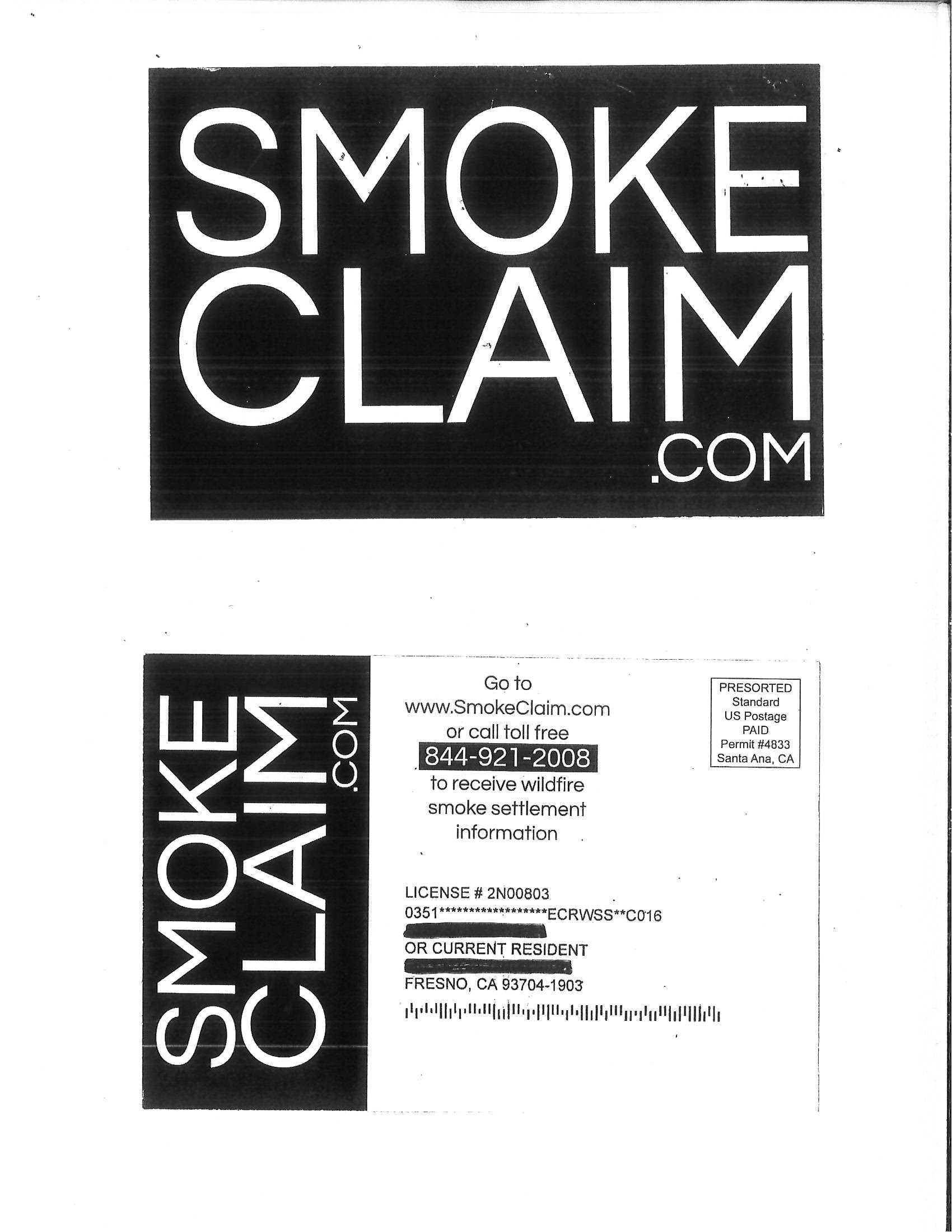

The investigation found California Recovery Group (CRG) and its owner, Youssefi, were soliciting business at consumers’ homes and sending mass mailers in an effort to file insurance claims related to damage caused by wildfires. The mailers prompted consumers to visit the website SmokeClaim.com or call a number in order to receive wildfire smoke settlement information.

“When disaster strikes it can be confusing for homeowners to know where to turn to and this company took advantage of that difficult situation in violation of California’s consumer protection laws,” said Insurance Commissioner Ricardo Lara. “Thanks to the hard work of my Department’s investigators and legal team, this company has been stopped. We are committed to protecting consumers following a wildfire or other disaster and ensuring they have the information and tools they need.”

Investigators found CRG and its representatives would often mislead prospective clients by telling them the program was funded by the State of California. They would also tell them that there would be no claim against their homeowner’s insurance and their insurance rates would not be affected. Homeowners were told since the wildfires were declared a catastrophic event, there would be no impact on their existing insurance policy. In fact, homeowner’s insurance typically covers smoke damage.

Department of Insurance investigators found CRG submitted insurance claims without the knowledge or consent of the homeowners and listed themselves as a payee on some of the submitted claims. CRG representatives canvassed neighborhoods in search of clients and were not licensed by the Department.

Records indicate there may be additional victims and the investigation is on-going. Anyone who believes they may be a victim should contact the Department at (323) 278-5000.

The Department of Insurance urges people to read our guide, Don’t Get Scammed After a Disaster, to help avoid this situation. Consumers should make sure any insurance agent or public adjuster offering their services has a valid license by checking online with the Department of Insurance. Public adjusters cannot solicit business for seven calendar days after the disaster.

Youssefi agreed to surrender his licenses to the Department. He will be prohibited from working in the insurance industry in any capacity for eight years.

Media notes:

Led by Insurance Commissioner Ricardo Lara, the California Department of Insurance is the consumer protection agency for the nation's largest insurance marketplace and safeguards all of the state’s consumers by fairly regulating the insurance industry. Under the Commissioner’s direction, the Department uses its authority to protect Californians from insurance rates that are excessive, inadequate, or unfairly discriminatory, oversee insurer solvency to pay claims, set standards for agents and broker licensing, perform market conduct reviews of insurance companies, resolve consumer complaints, and investigate and prosecute insurance fraud. Consumers are urged to call 1-800-927-4357 with any questions or contact us at www.insurance.ca.gov via webform or online chat. Non-media inquiries should be directed to the Consumer Hotline at 800-927-4357. Teletypewriter (TTY), please dial 800-482-4833.