Curbing California's Underground Economy

California's underground economy results in a multi-billion dollar hit to California's economy. This fraudulent activity hurts legitimate businesses that play by the rules. Leveling the playing field requires a dedicated and coordinated effort with allied agencies all working together to put a stop to the illegal activities of business owners that not only cheat the system at the expense of law-abiding businesses and consumers, but also exploit workers to gain an unfair advantage.

What is the underground economy?

The problem:

When businesses operate in the underground economy, they illegally reduce the amount of money expensed for insurance, payroll taxes, licenses, employee benefits, safety equipment, and safety conditions. Businesses that operate in the underground economy gain an unfair competitive advantage over legitimate businesses that comply with state laws. This results in unfair competition in the marketplace and forces law-abiding businesses to pay higher taxes and expenses.

Types of fraud that feed the underground economy:

Examples of workers' compensation insurance premium fraud include under-reporting to carriers the correct number of employees and wages paid, misclassifying the type of work employees are doing, and by misrepresenting their claims history through experience modification evasion schemes. Investigators have found that employers who commit this type of fraud are often also cheating on employment taxes, licensing fees, corporate and personal income taxes, sales taxes, and other employment contributions required by law.

Another form of employer fraud related to the underground economy is claim dissuasion, where an employer prevents an employee from filing a legitimate workers' compensation claim through an outright lie to the employee about their right to file and injury claim and/or through concealment of some fact that affects and injured claimant's collection of rightful benefits.

The exploitation of workers is a significant part of the underground economy. CDI has joined the Santa Clara County’s Worker’s Exploitation Task Force to protect and heal the victims of labor trafficking, wage theft and illegal exploitation. Additionally, to combat the exploitation of workers, CDI works joint cases with the US Department of Labor and the California Labor Commissioner’s Office.

What CDI is doing to curb the underground economy:

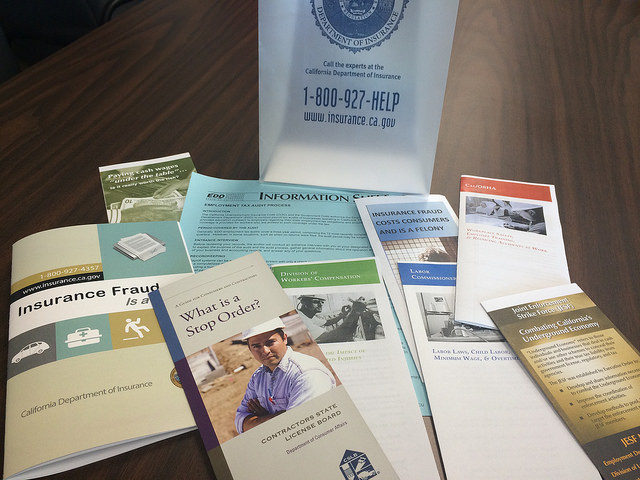

The Department of Insurance's Fraud Division has teams of detectives set up throughout California to combat the underground economy through proactive enforcement of state criminal insurance fraud statues covering workers' compensation premium fraud and other types of employer fraud. The Fraud Division also conducts numerous trainings and outreach efforts throughout the year to industry groups, labor organizations, law enforcement and public agencies that have an interest in combatting the underground economy. These training and outreaches cover topics such as identifying underground economy red flags, reporting suspected violations, investigative techniques, and best practices of cooperation among agencies.

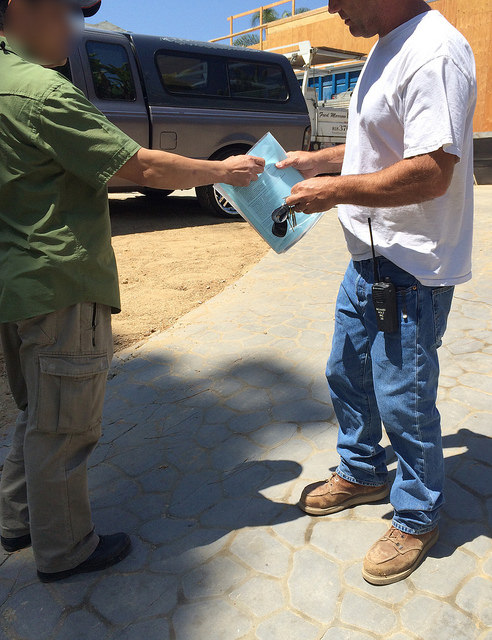

To effectively combat the underground economy, Department of Insurance detectives frequently participate in enforcement operations with other agencies as part of the Joint Enforcement Strike Force, the Labor Enforcement Task Force, and other more localized underground economy task forces. Agencies involved in these task forces include the Employment Development Department, Contractors' State License Board, Labor Commissioner's Office, Franchise Tax Board, Board of Equalization, Internal Revenue Service and other agencies with an interest in combatting the underground economy.

Find out more about what CDI is doing to help protect California's business economy.

Educating businesses about the law

CDI has executed nearly 100 outreach events over the past three years.

Related news:

- Multiple state agencies combine efforts to conduct statewide underground economy sweep - many violations found

- CDI leads a multi-state task force in statewide underground economy sweep

Bringing to justice those that cheat the system

349 arrests related to the underground economy over the last three years.

Related news:

- Thriving underground economy targeted in statewide multi-agency outreach and enforcement effort

- $500 million medical and workers' comp fraud conspiracy uncovered

- Indictment in $17 million workers' compensation insurance over billing scheme

- Husband & wife failed to report estimated $15 million in payroll

- Floor Care business owners charged with 61 felony counts in $5 million scheme

- Bomb-strapped bank robbery co-conspirator charged with workers' comp fraud

Protecting California's workforce

More than $37 million in restitution and fines over the last three fiscal years.

Related news: AIG to Pay $15.6 million fine for underreporting workers' compensation payments

Statutes related to the underground economy that the Enforcement Branch is directly charged with enforcing include:

Workers' Compensation Insurance Premium Fraud

- Insurance Code section 11760: (a) It is unlawful to make or cause to be made any knowingly false or fraudulent statement, whether made orally or in writing, of any fact material to the determination of the premium, rate, or cost of any policy of workers' compensation insurance, for the purpose of reducing the premium, rate, or cost of the insurance. Any person convicted of violating this subdivision shall be punished by imprisonment in a county jail for one year, or pursuant to subdivision (h) of section 1170 of the Penal Code for two, three, or five years, or by a fine not exceeding fifty thousand dollars ($50,000), or double the value of the fraud, whichever is greater, or by both that imprisonment and fine.

- Insurance Code section 11880: (a) It is unlawful to make or cause to be made any knowingly false or fraudulent statement, whether made orally or in writing, of any fact material to the determination of the premium, rate, or cost of any policy of workers' compensation insurance issued or administered by the State Compensation Insurance Fund for the purpose of reducing the premium, rate, or cost of the insurance. Any person convicted of violating this subdivision shall be punished by imprisonment in a county jail for one year, or pursuant to subdivision (h) of section 1170 of the Penal Code for two, three, or five years, or by a fine not exceeding fifty thousand dollars ($50,000), or double the value of the fraud, whichever is greater, or by both that imprisonment and fine.

Workers' Compensation Insurance Claim Dissuasion Fraud

- Penal Code section 550 (b)(3): It is unlawful to do, or to knowingly assist or conspire with any person to do, any of the following: Conceal, or knowingly fail to disclose the occurrence of, an event that affects any person's initial or continued right or entitlement to any insurance benefit or payment, or the amount of any benefit or payment to which the person is entitled.

- Insurance Code section 1871.4 (a)(4): It is unlawful to do any of the following: Make or cause to be made a knowingly false or fraudulent statement with regard to entitlement to benefits with the intent to discourage an injured worker from claiming benefits or pursuing a claim.

Helpful links:

Links to Underground Economy Task Forces with which the Department of Insurance Enforcement Branch participates: