Flood Insurance Resources

Many people may not be aware that homeowners’ and commercial insurance policies typically exclude flood, mudslide, debris flow, and other similar disasters. Further, the California FAIR Plan, currently does not cover any storm-related damage unless a consumer has purchased a supplemental “difference in conditions” (DIC) policy from another insurance company. Experts at the Department of Insurance suggest Californians, including those in traditionally low-risk areas, take the time to assess your flood risk today and determine if you need coverage before the next storm.

If you have a question about your insurance or a dispute with your insurance company, please call us at 1-800-927-4357 or use the Consumer Hotline Chat button below. We hope the information listed below can help you understand some of the key flood insurance coverage terms that typically apply, prepare you for the process of making and settling a claim, and help you to avoid some of the pitfalls that can occur along the way.

Obtain Assistance from CDI:

Flood Overview

Flooding is the nation's number one natural disaster. While floods occur in every area of the country, many property owners remain unprepared. Standard homeowners' insurance does not cover flood damage. Therefore, it is important to know what options are available to protect your assets from flood losses. The U.S. Congress established the National Flood Insurance Program (NFIP) in 1968. The NFIP is a federal program enabling property owners in participating communities to purchase insurance as a protection against flood losses. Participating in the NFIP is based on an agreement between communities and the Federal Government. The program is administered by the Federal Emergency Management Agency (FEMA) and provides flood insurance protection to property owners, renters, and business owners in communities that participate in the program. For additional information about NFIP, visit floodsmart.gov.

How Flood Insurance Works

Sale of Flood Policies

As long as a community participates in the NFIP, residents are eligible to purchase flood insurance. Flood insurance is sold to property owners located in NFIP communities through state licensed property and casualty insurance agents and brokers who deal directly with FEMA; or private insurance companies through a program known as Write Your Own (WYO). Here is a list of participating WYO companies.

You should talk to your insurance agent if you have questions, would like additional information and/or are ready to purchase a flood insurance policy. If your insurance agent does not sell flood insurance, you can contact the NFIP Help Center at 1-877-336-2627 to request an agent referral.

Policy Effective Date

The policy will take effect 30 days after it is purchased. However, if you buy a house in a designated high-risk area and receive a mortgage loan from a federally regulated lender, by law, the lender must require the borrower to purchase and regularly renew flood insurance. In this case, the policy will take effect immediately and the borrower does not have to wait 30 days.

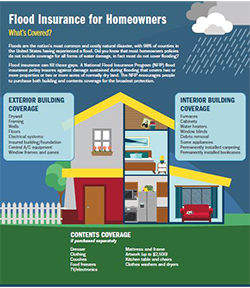

Flood Insurance Coverage

In general, coverage is provided for direct physical loss to the property from a flood which is described as:

A general and temporary condition of partial or complete inundation of two or more acres of normally dry land area or of two or more properties (at least one of which is your property) from:

- Overflow of inland or tidal waters

- Unusual and rapid accumulation or runoff of surface waters from any source

- Mudflow - Mudflow is defined as a river of liquid and flowing mud on the surfaces of normally dry land areas such as when earth is carried by a current of water. Landslide, slope failures, or saturated soil moving down a slope are not mudflows.

In general, the policy excludes losses caused by earth movement, even if the earth movement is caused by flood. Examples of excluded earth movement include:

- Earthquake

- Landslide

- Land subsidence

- Sinkholes

- Destabilization or movement of land resulting from accumulation of water.

- Gradual erosion

Regulatory Jurisdiction

The California Department of Insurance does not regulate the National Flood Insurance Program (NFIP). Flood insurance is a federal program. You can call 1-800-638-6620 to report a claim or find the specific NFIP toll-free phone number for claims and policy inquiries.