Commissioner announces more than 1 million homes now have protection from insurance non-renewal

News: 2019 Press Release

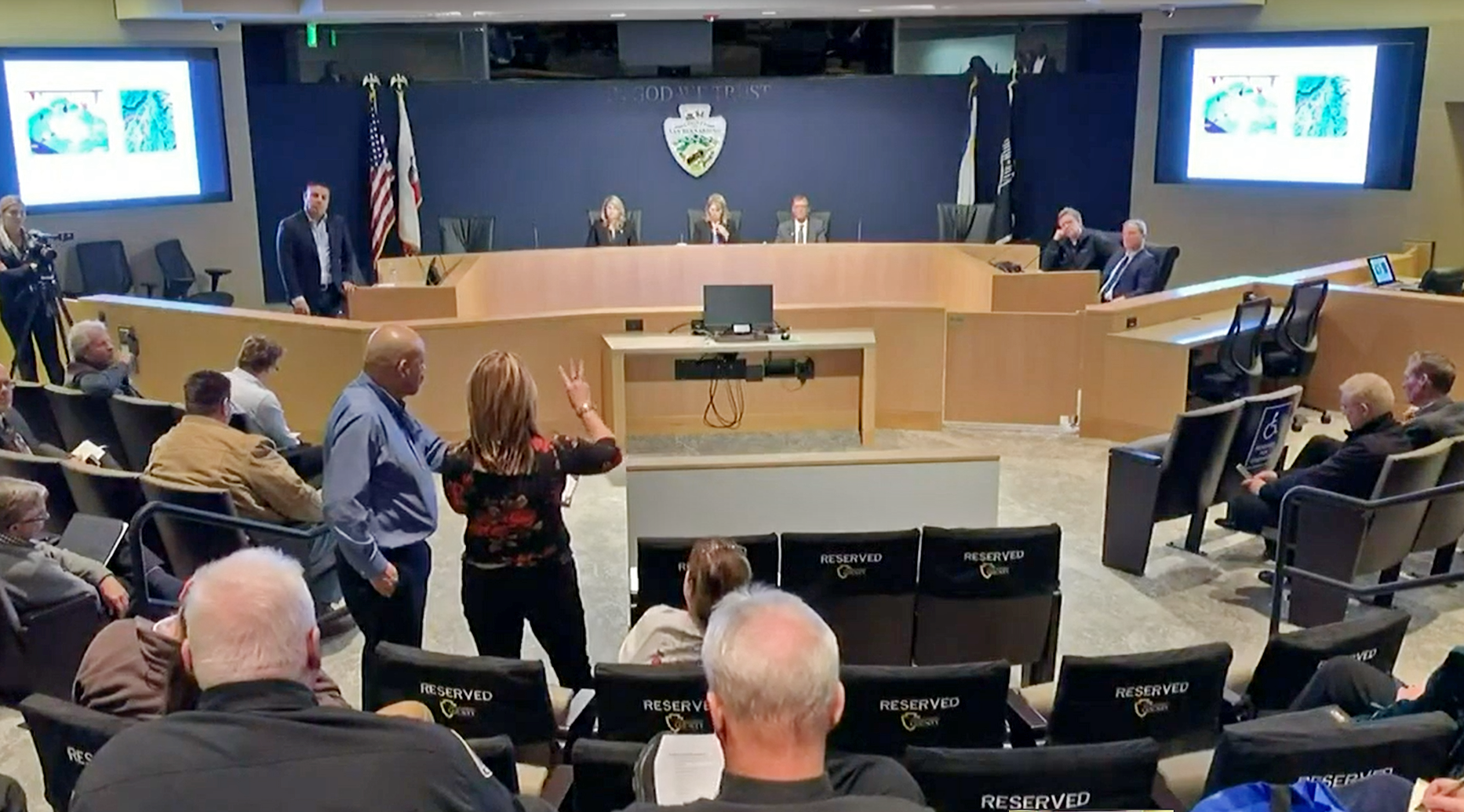

Insurance Commissioner Ricardo Lara spoke at a roundtable with San Bernardino County residents.

SAN BERNARDINO, Calif. — Last night in San Bernardino, Insurance Commissioner Ricardo Lara announced first-ever mandatory protections from insurance non-renewals extend into new areas of Northern and Southern California following recent wildfire disasters — bringing the total to more than 1 million homes statewide that are protected under a new law that he authored last year while serving as a state senator.

The Department of Insurance released an updated bulletin to insurance companies specifying additional ZIP codes adjacent to recent wildfires in parts of San Bernardino and Riverside counties, including the mountain communities of Big Bear and Lake Arrowhead, as well as parts of Contra Costa, Solano and Ventura counties protected by the moratorium against nonrenewals and cancellations of residential property policies. It brings the total number of included wildfires to 16.

Commissioner Lara's announcement at an insurance roundtable with San Bernardino County community leaders builds on his history-making action to implement the law on December 5.

“The communities in the San Bernardino Mountains were some of the first to suffer the destabilizing impact that insurance non-renewals have on local communities, and they are among the first to receive much-needed breathing room under our new state law,” said Commissioner Lara. “This wildfire insurance crisis has been years in the making, but it is an emergency we must deal with now if we are going to keep the California dream of home ownership from becoming the California nightmare, as an increasing number of homeowners struggle to find coverage. I look forward to working with our Legislature and local communities on additional lasting solutions.”

The mandatory one-year moratorium covers residential policies in ZIP codes adjacent to recent wildfire disasters under the newly enacted Senate Bill 824 (Lara, Chapter 616, Statutes of 2018), also known as the “Wildfire Safety and Recovery Act.” While existing law prevents non-renewals for those who suffer a total loss, the new law established protection for those living adjacent to a declared wildfire emergency who did not suffer a total loss — recognizing for the first time in law the disruption that non-renewals cause in communities following wildfire disasters.

Because the homeowner insurance crisis extends beyond these 16 wildfire perimeters and impacts residents statewide, Commissioner Lara has also called on insurance companies to voluntarily cease all non-renewals related to wildfire risk statewide until December 5, 2020, in the wake of Governor Gavin Newsom’s declaration of statewide emergency due to fires and extreme weather conditions. A statewide moratorium would provide all California homeowners, renters, and businesses peace of mind, and allow time for stakeholders to come together to work on lasting solutions, help reduce wildfire risk, and stabilize the insurance market.

“Home insurance is not a luxury — it's a necessity. Yet for hundreds of thousands of Californians, it's become almost impossible to find and afford. This puts people between a rock and a hard place, and communities up and down the state are hurting,” said Amy Bach, Executive Director of United Policyholders. “At United Policyholders, we are doing all we can to help consumers deal with this situation and we thank Commissioner Lara for authoring the moratorium bill and agreeing to take further action with a statewide voluntary moratorium.”

Following Governor Newsom's emergency declarations in October, the Department of Insurance partnered with CALFIRE and the Governor’s Office of Emergency Services to identify wildfire perimeters and adjacent ZIP codes within the mandatory moratorium area.

Commissioner Lara's action comes amid growing evidence that homeowner insurance has become more difficult for Californians to obtain from traditional markets, forcing them into more expensive, less comprehensive options such as the FAIR Plan that do not offer the same level of coverage or protections.

In August, the Department of Insurance released data revealing insurance companies are dropping an increasing number of residents in areas with high wildfire risk. The number of non-renewals rose by more than 10% last year in seven counties from San Diego to Sierra — a direct response to California’s recent devastating wildfires. The number of consumers covered by the FAIR Plan — California’s insurer of last resort — has surged in areas with high wildfire risk. According to the U.S. Forest Service, more than 3.6 million California households are located in the wildland urban interface where wildfires are most likely to occur.

Yesterday's action builds on Commissioner Lara’s order last month to modernize the FAIR Plan and strengthens our insurance safety net. No later than June 1, 2020, the FAIR Plan will expand its coverage to offer a full homeowners policy in addition to its current limited fire-only policy. By April 1, 2020, the FAIR Plan will increase the Dwelling Fire combined policy limit from $1.5 million to $3 million, in recognition of higher home values. By February 1, 2020, the FAIR Plan will offer a monthly payment plan without fees and allow people to pay by credit card or electronic funds transfer without fees.

# # #

Media Notes:

- Consumers can go to the Department of Insurance website to find the bulletin to see if their ZIP Code is included in the moratorium, which includes the 16 wildfire disasters affected by Governor Newsom’s emergency declarations: 46 Fire, Eagle, Easy, Getty, Glen Cove, Hill, Hillside, Kincade, Maria, Reche, Saddle Ridge, Sandalwood, Sky, Tick, Water, and Wolf fires.

- Voluntary moratorium notice for wildfire risk to all California insurers.

- Governor’s emergency declarations:

- Governor Newsom Declares Statewide Emergency Due to Fires, Extreme Weather Conditions (October 27, 2019)

- Governor Newsom Declares State of Emergency in Sonoma and Los Angeles Counties Due to Fires (October 25, 2019)

- Governor Newsom Declares State of Emergency in Los Angeles and Riverside Counties Due to Fires (October 11, 2019)

- New Data Shows Insurance Is Becoming Harder to Find as a Result of Wildfires (Department of Insurance Press Release, August 20, 2019)

- Commissioner Lara Announces Insurance Strike Team During Meetings with County Leaders (Department of Insurance Press Release, August 8, 2019)

Led by Insurance Commissioner Ricardo Lara, the California Department of Insurance is the consumer protection agency for the nation's largest insurance marketplace and safeguards all of the state’s consumers by fairly regulating the insurance industry. Under the Commissioner’s direction, the Department uses its authority to protect Californians from insurance rates that are excessive, inadequate, or unfairly discriminatory, oversee insurer solvency to pay claims, set standards for agents and broker licensing, perform market conduct reviews of insurance companies, resolve consumer complaints, and investigate and prosecute insurance fraud. Consumers are urged to call 1-800-927-4357 with any questions or contact us at www.insurance.ca.gov via webform or online chat. Non-media inquiries should be directed to the Consumer Hotline at 800-927-4357. Teletypewriter (TTY), please dial 800-482-4833.