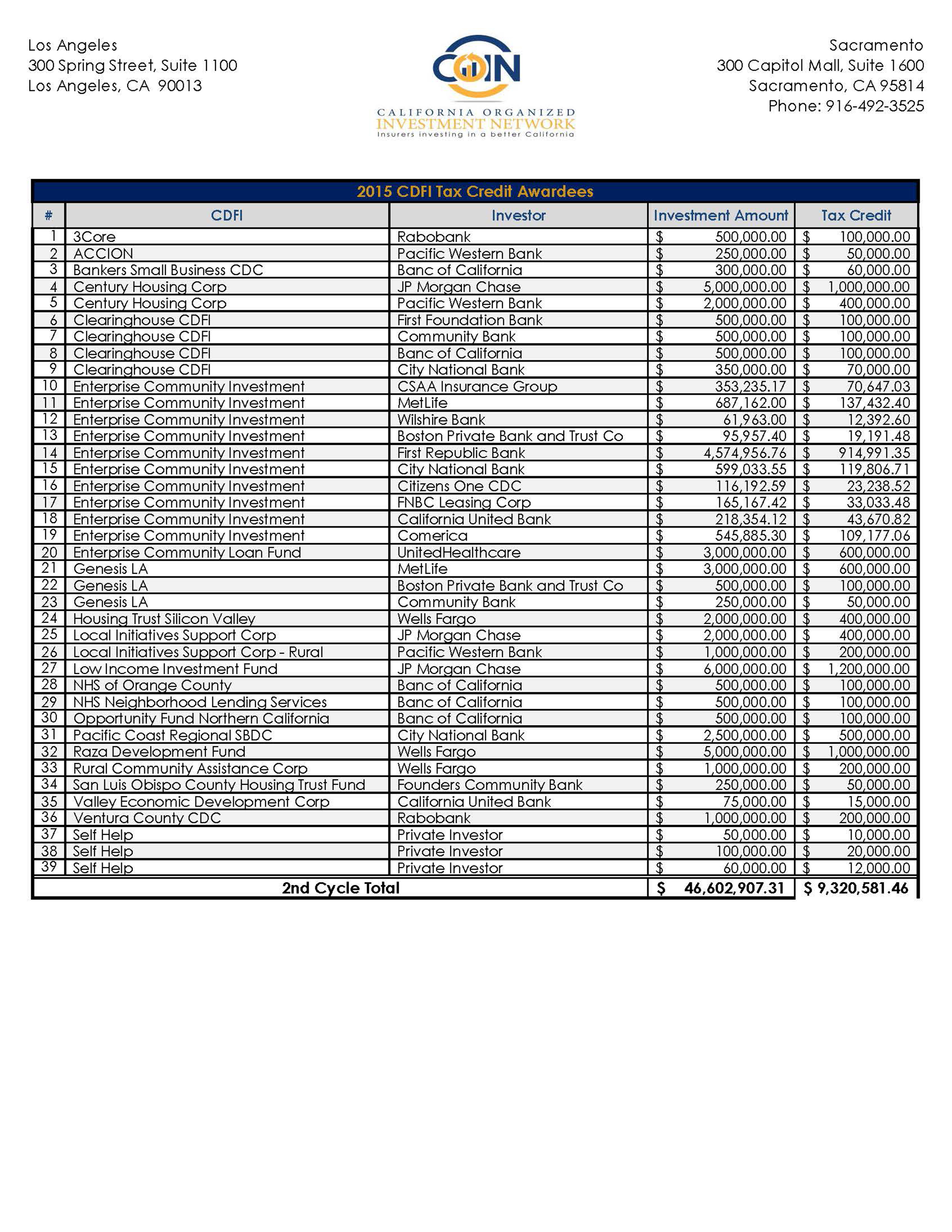

Tax credits awarded to insurers investing in California’s underserved communities

News: 2015 Press Release

SACRAMENTO,

Calif. — California Insurance Commissioner Dave Jones today

announced $9.3 million in tax credits awarded to insurance companies and other

investors that made more than $46.6 million in capital investments into

California’s underserved communities through the second round of the 2015 California

Organized Investment Network (COIN) Community Development Financial Institution

(CDFI) tax credit cycle.

“The COIN CDFI tax credit program successfully attracts needed investments

in California’s underserved communities,” said Commissioner Jones. “This

program is an extraordinary example of the kind of innovative public-private

partnership making a difference for both our communities and the insurance

marketplace.”

Each year the Department of Insurance may award up to $10 million in tax

credits to support $50 million in capital from insurance companies and other

investors for community development. Investors earn a tax credit worth 20

percent of their investment.

This capital helps CDFIs create jobs, build affordable housing and fund

other projects that improve the quality of life in communities and

neighborhoods throughout the state.

Among others, COIN CDFI Tax Credits were awarded to:

- CSAA Insurance Group for its $353,235 investment into Enterprise Community Investment for the California Hotel project in Oakland that provides for the rehabilitation of 137 units of affordable rental housing, including 119 efficiencies, 34 units for special needs households, and 15 units for homeless persons with mental illness.

- MetLife Insurance Company for its $3 million investment into Genesis LA Economic Growth Corp that will promote safe and healthy communities in underserved areas of Los Angeles County through a learning center that provides summer camps and school enrichment programs, workforce development programs, and funding for a homeless servicing agency.

- United HealthCare for its $3 million investment into Enterprise Community Loan Fund to support and leverage financing for the development and preservation of affordable housing and Federally Qualified Health Centers for low-income families across the State.

- MetLife Insurance Company for its $687,162 investment into Enterprise Community Investment that will leverage additional capital to rehabilitate Gabilan Plaza apartments, an affordable housing project for low to moderate-income families in Salinas. The rehabilitation will include adding photovoltaic panels and converting ten units for handicap accessibility.

The COIN CDFI tax credit program provides tax credits to investors and helps CDFIs raise funds for projects that create social and environmental benefit in California. Without the COIN CDFI Tax Credit program, many of these community development projects would not be funded.

Media Notes:

Established in 1996, COIN is a collaborative effort between the California

Department of Insurance, insurance industry, community affordable housing and

economic development organizations, and community advocates to support

investments benefitting California's environment and low-to-moderate (LMI)

income and rural communities. For more information, go online at www.insurance.ca.gov/0250-insurers/0700-coin

Led by Insurance Commissioner Ricardo Lara, the California Department of Insurance is the consumer protection agency for the nation's largest insurance marketplace and safeguards all of the state’s consumers by fairly regulating the insurance industry. Under the Commissioner’s direction, the Department uses its authority to protect Californians from insurance rates that are excessive, inadequate, or unfairly discriminatory, oversee insurer solvency to pay claims, set standards for agents and broker licensing, perform market conduct reviews of insurance companies, resolve consumer complaints, and investigate and prosecute insurance fraud. Consumers are urged to call 1-800-927-4357 with any questions or contact us at www.insurance.ca.gov via webform or online chat. Non-media inquiries should be directed to the Consumer Hotline at 800-927-4357. Teletypewriter (TTY), please dial 800-482-4833.